Where Alpha Lives

Intelligence that adapts. Discipline that endures. Performance that defines.

Our Strategy has generated:

%

Annualized Return

Sharpe Ratio

%

Max Monthly Drawdown

%

Positive 12M Rolling Periods

* Results Since 2007

Alpha Intel assists stewards of capital to achieve a superior risk-adjusted return, regardless of economic conditions.

Our technology employs leading edge analytics that generate alpha throughout the entire market cycle.

Harness the cognitive power of Advanced Intelligence to uncover, optimize, and sustain investment alpha.

Our objective is to create →

Alpha Intel

Adaptive Intelligent Portfolio

We realize our objective through Alpha Intel’s Adaptive Intelligent Portfolio. Our solution provides professional advisors the opportunity to enhance their clients’ portfolios in three ways:

- Return maximization

- Risk minimization

- A blended balance of both

The Adaptive Intelligent Portfolio is:

- Customized to each advisor’s goals and client profile

- Continuously updated and rebalanced in real time

- Actionable, measurable, and practical in execution

- Adaptive to changing market conditions and risks

- Transparent, data-driven, and easy to understand

Experience Adaptive Intelligence in Portfolio Construction

Explore how dynamic investment systems respond to real market regimes.

This interactive demonstration provides a window into Alpha Intel’s adaptive investment framework.

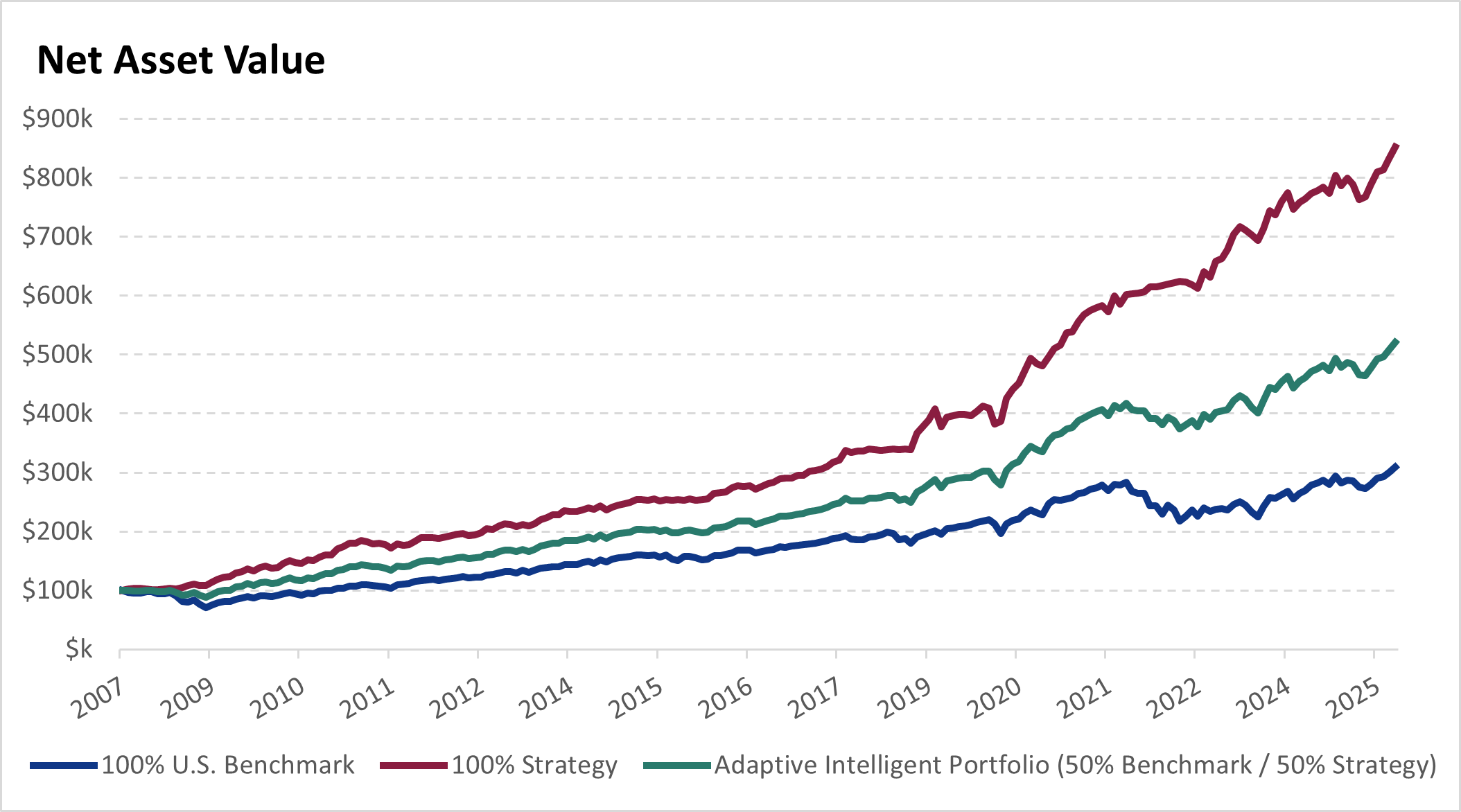

Net Asset Value

USA Benchmark

Strategy

Adaptive Intelligent Portfolio

Navigating markets well requires one to find subtleties in the data to determine what is going to happen, rather than relying on the consensus view built into the price.

Quantitative-oriented research drives our approach to portfolio construction. We focus on:

Intermediate term market anomalies

Capturing liquid, uncorrelated sources of return

Cost-efficient implementation

Strategies that are robust, regardless of economic cycles

Maximum liquidity

Effective, logical and well-documented strategies

At Alpha Intel, accurate and timely data are the foundation that underlies our strategies.

Our forecasts are tested using rigorous statistical methods well-grounded in economic rationale.

Alpha Intel strategies are designed to add alpha to a host of asset classes, balanced portfolios, multi-factor portfolios and investment themes.

Our Strategies have been developed to target many different market risks and sources of returns.

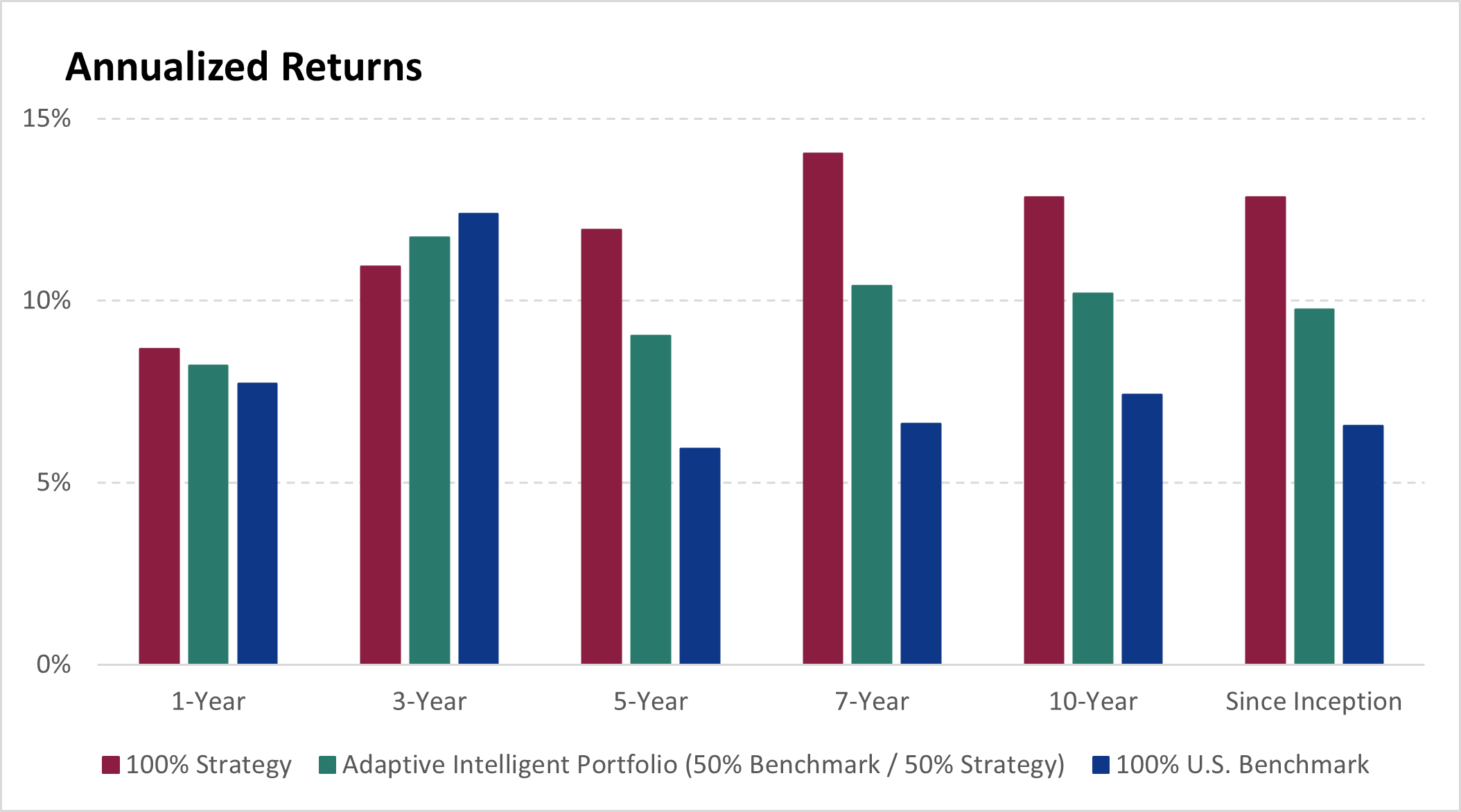

– Adaptive Intelligent Portfolio is a 50/50 weighting between the Strategy and Benchmark

– Results as at September 30, 2025 and include a 1% annual MER

Disclaimer: Past performance does not guarantee future results.